The systematic transformation of data into commercial opportunities is channelled through the Customer Relationship Management (CRM) division, which comprises mathematicians, engineers, economists, IT specialists and data scientists. Here, data is analysed in depth, creating business rules, algorithms or models and commercial actions are defined and customer interactions overseen.

In 2018, the new General Data Protection Regulation came into force in the European Union, regulating aspects including but not limited to the extent to which customers are willing to be contacted by the company, the type of data they want the bank to use and the type of offers they want to be informed about. This regulation, in addition to being positive for consumers, emphasises the dedication with which Bankinter interacts with its customers, ensuring compliance with the regulations at all times.

Over the course of the year, progress has also been made on the construction and improvement of models. In Corporate Banking, efforts have focussed mainly on predicting investment demand, whilst in Commercial Banking, work has centred around models for predicting the contracting of specific products, systems of recommendation and foreseeing possible abandonment. To this end, Bankinter employs new Big Data technologies and programming languages (R and Python). Furthermore, Bankinter uses the power of analysis in CRM in all aspects essential to the business, which helps to appraise corporate expansion opportunities.

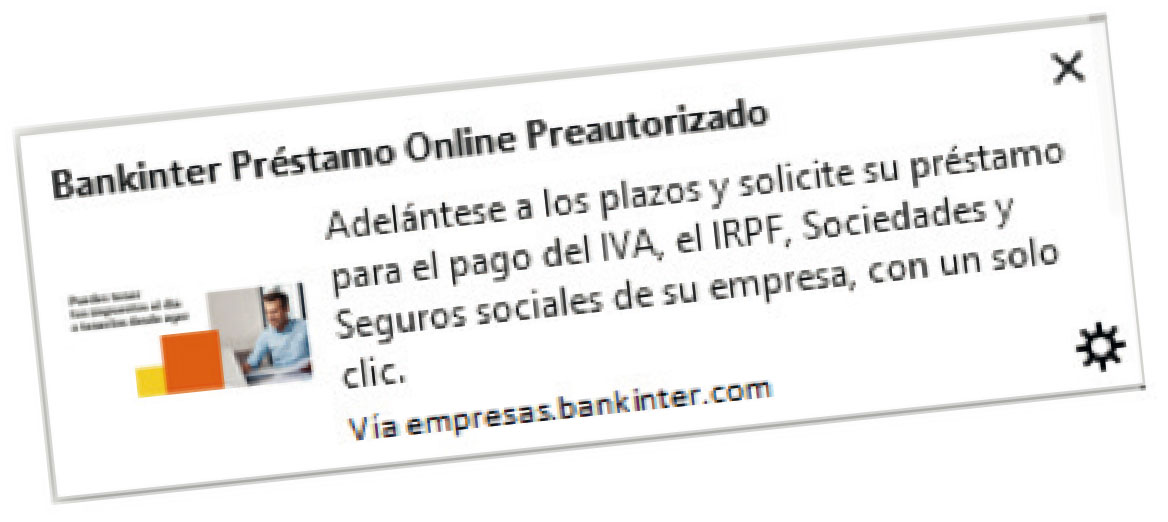

On the other hand, CRM harnesses the greater level of customisation possible on the entity's website and app to develop customer interaction, which is increasingly necessary in the digitalised world in which the sector operates.

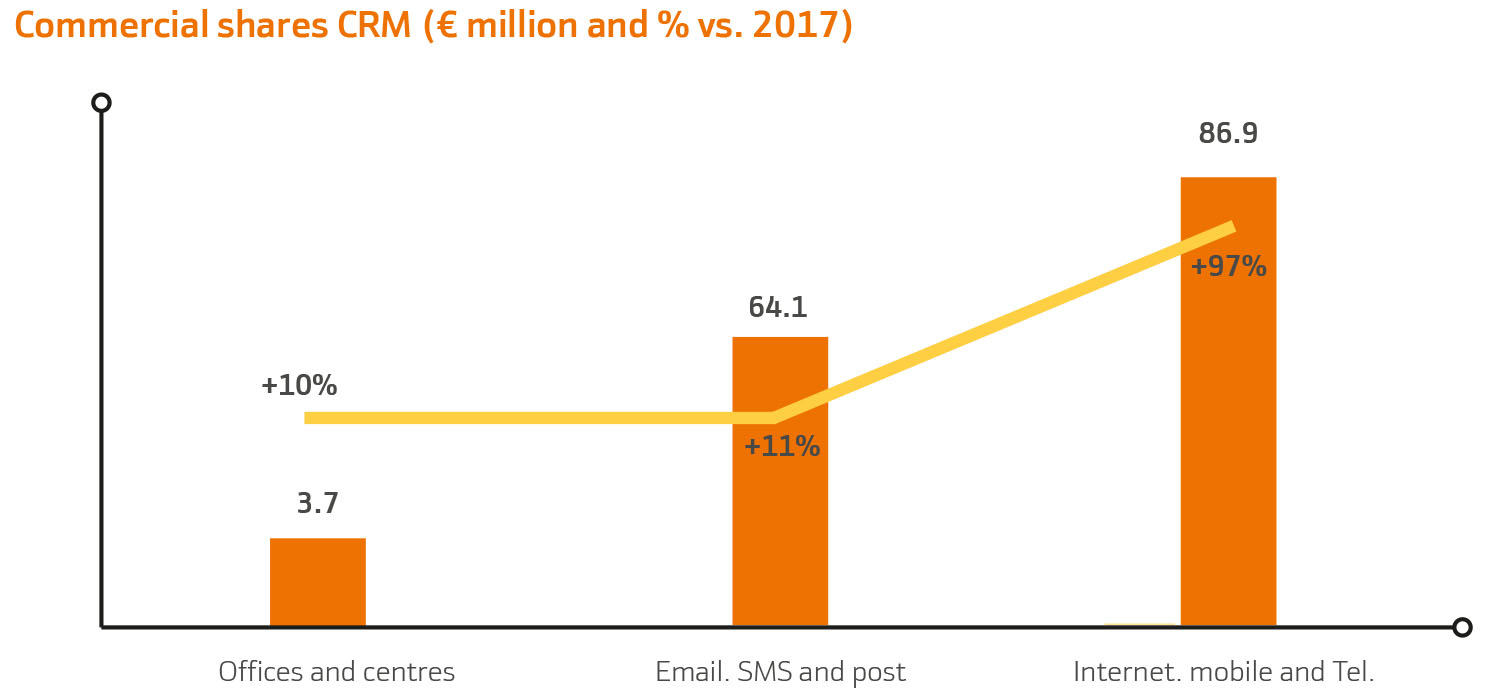

In 2018, Bankinter continued to increase its commercial activities. Sales managers and private bankers increased their commercial endeavours by 10%. The same rate of growth was seen in dispatches. However, the biggest leap occurred in digital interaction, where the commercial impact doubled.

Other relevant actions in the year were as follows:

The commercial intelligence function, allocated to the CRM division, provides the entity with in-depth knowledge of what is happening on the market and facilitates the process of allocating demanding yet achievable objectives.

We use our own and third-party cookies to improve our services and show you advertising related to your preferences by analyzing your browsing habits. If you go on surfing, we will consider you accepting its use. You can get more information, or know how to change the configuration in our Cookies Policy. Accept