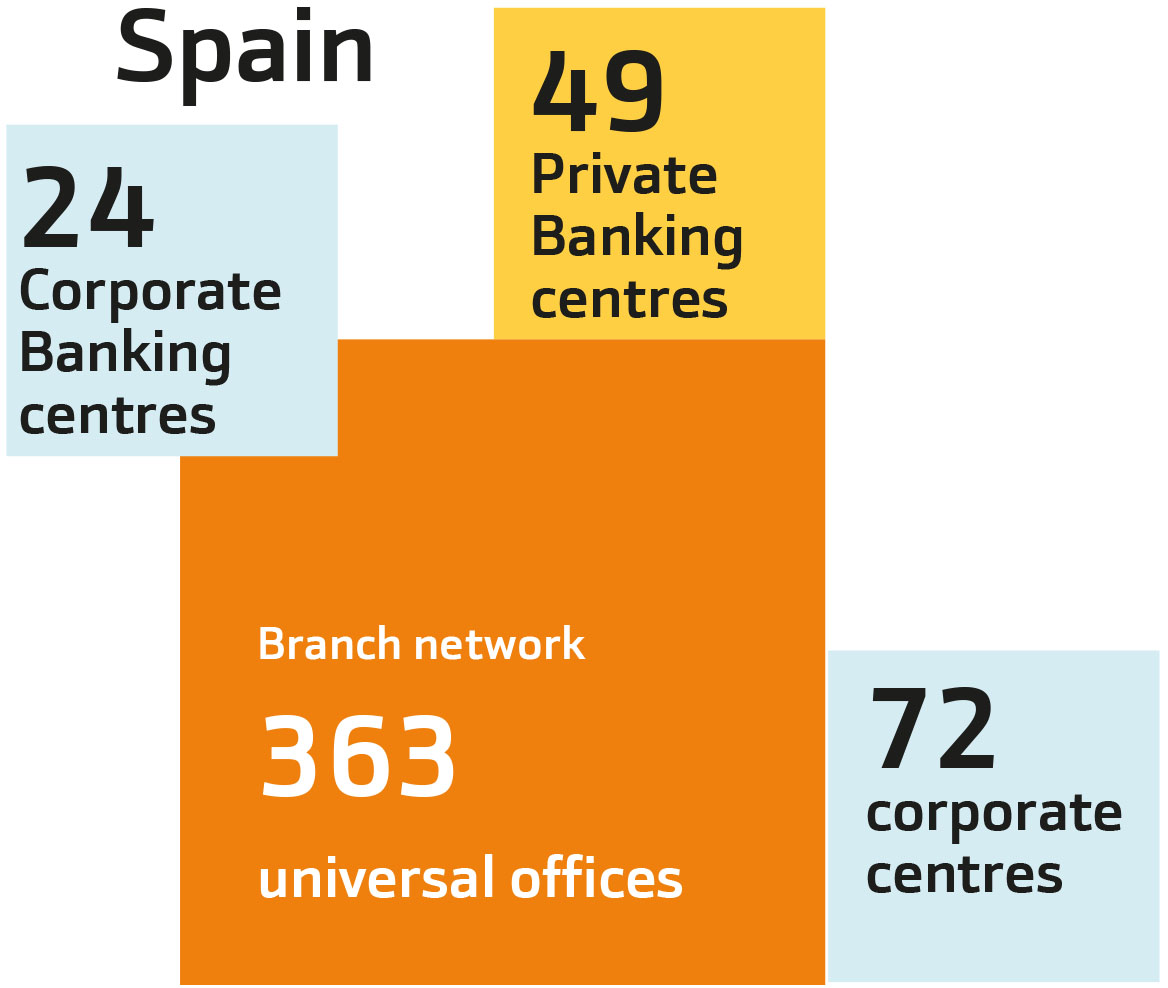

At the end of 2018, Bankinter Spain's Network comprised 363 universal offices, 49 Private Banking Centres, 72 Business Centres and 24 Corporate Banking Management Centres.

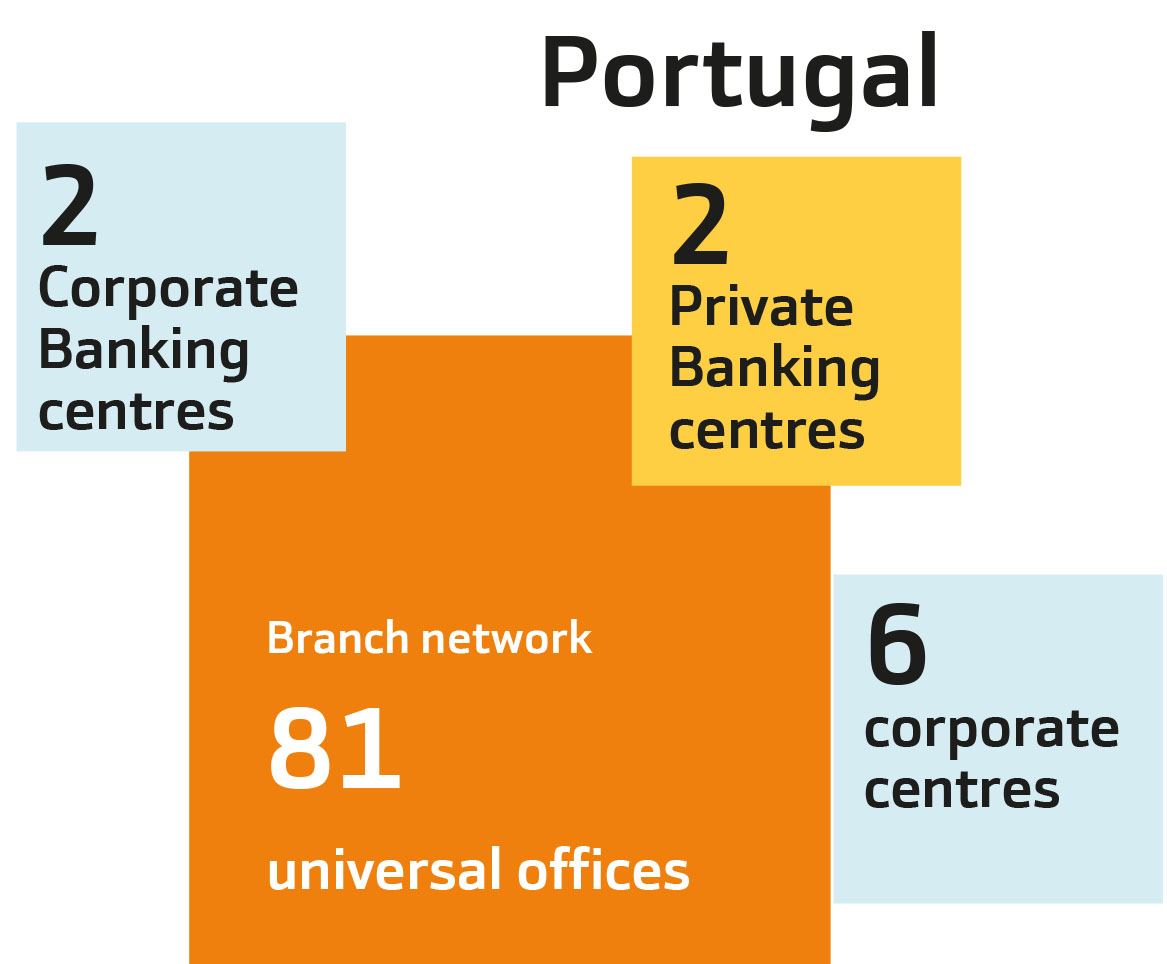

In Portugal, we have 81 Universal Offices, 2 Private Banking Centres, 6 Business Centres and 2 Corporate Banking Management Centres.

The universal offices service the Individual and Foreigners, Personal Banking and SME segments. The Private Banking centres are dedicated to customers with the most property assets. The scope of influence of Business centres covers mediumsized companies and Corporate Banking management centres cover big business.

The entire Network benefits from a high level of digitalisation, which makes processes faster and more convenient for customers, who no longer need to visit branches to perform the most common tasks. This also frees up the time of managers and allows them to dedicate themselves to tasks that entail the highest added value.

One of the new developments introduced in 2018 was the omnichannel activation process, as part of which the application to open an account can be started in one channel and finished in another. The customer, for example, has the option of identifying him/herself using a videoselfie and then signing the contract online or in hard copy, before handing it over to a courier wherever is convenient for him/her.

Last year, the use of the biometric signature on tablets was also consolidated at branches, with the subsequent reduction in paper usage; in addition, digital spaces were created in a hundred branches for customers who wish to do so to access the bank's website and perform consultations and transactions, without any assistance.

To successfully roll out these advances, a comparative advantage that Bankinter has compared to the other banks operating in Spain is fundamental. The level of digitalisation amongst its customers is higher and, furthermore, they are used to innovations, of which the Bank has many as it has always been a pioneer. According to the most recent data available, 92.5% of customers communicate with Bankinter indistinctly using digital and in-person channels, and only 7.5% prefer to be served exclusively in person.

The main challenge in 2019 is for the Branch Network to continue its progress with the digitalisation and personalisation of customer service.

We use our own and third-party cookies to improve our services and show you advertising related to your preferences by analyzing your browsing habits. If you go on surfing, we will consider you accepting its use. You can get more information, or know how to change the configuration in our Cookies Policy. Accept