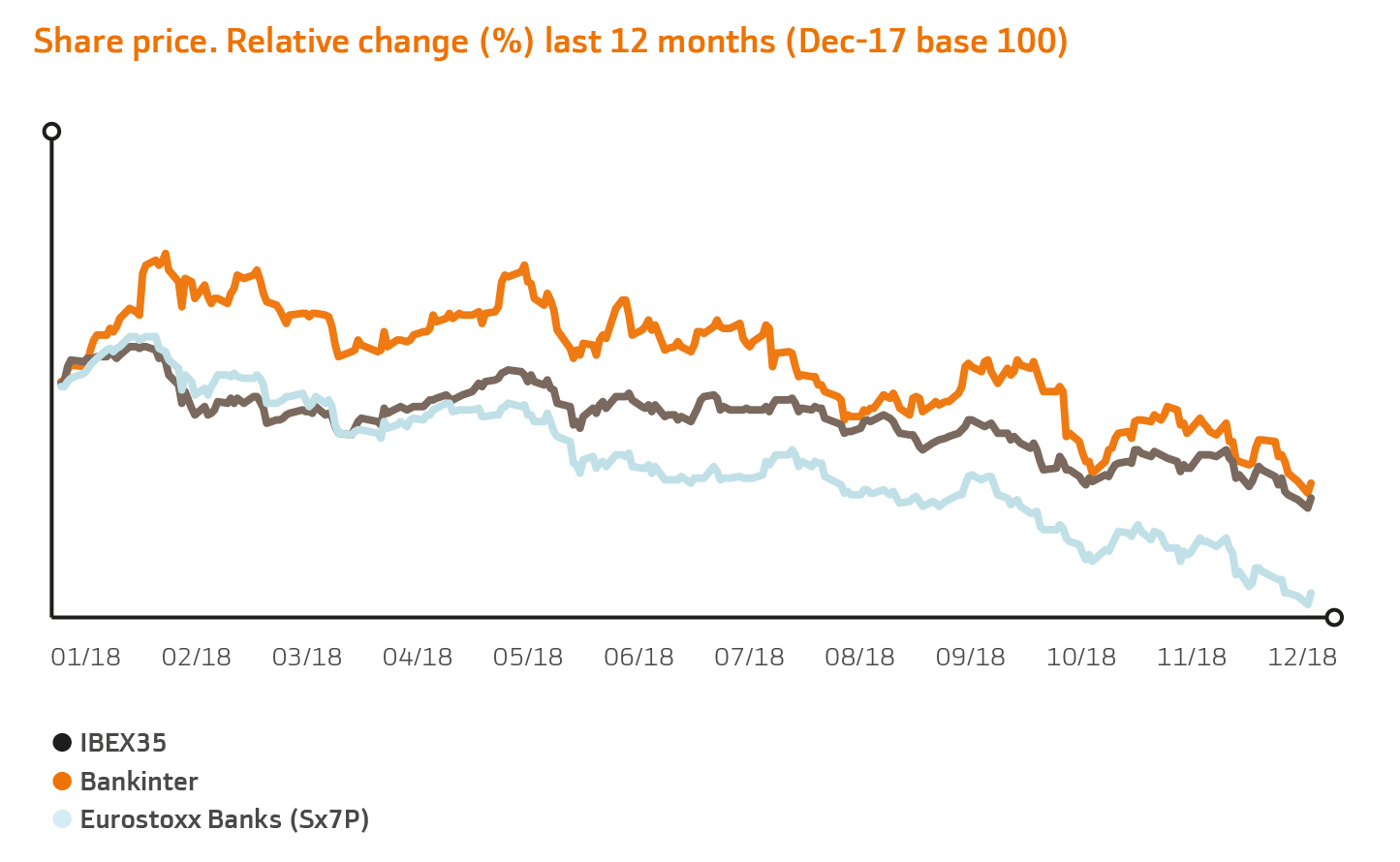

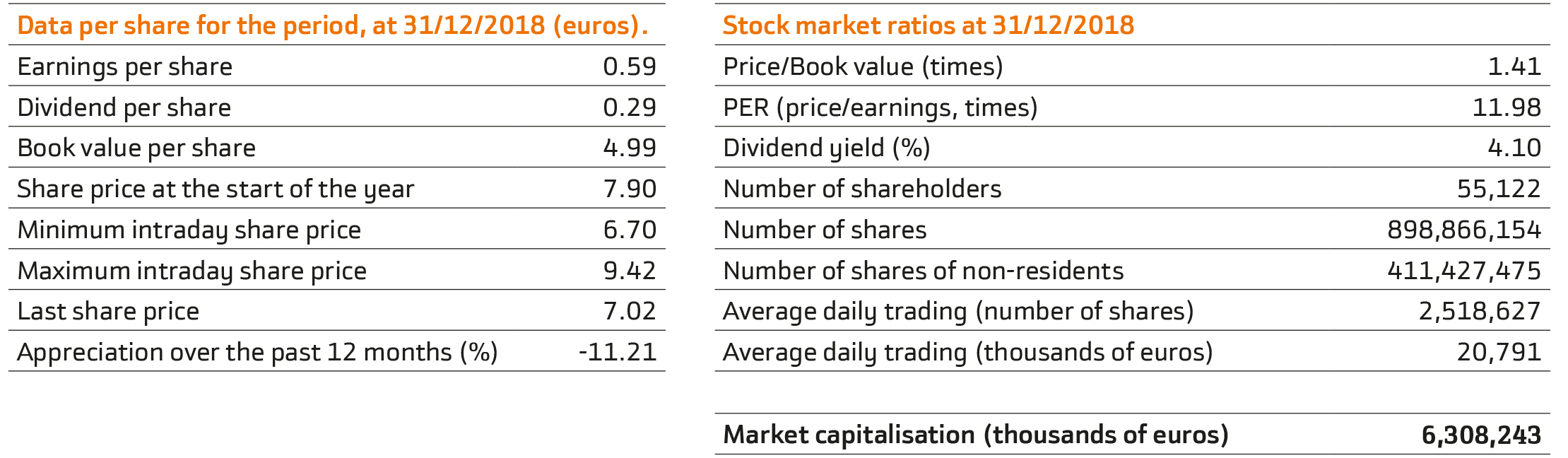

In this testing context, Bankinter's performance was acceptable, to some extent in line with the performance of the selective Spanish index and appreciably better than European bank indexes. Its share price dropped by 11.2%, although in February it reached historic highs of €9.4 per share. The Bank's market capitalisation at 31 December 2018 stood at €6,308 million. Shareholder return, including the dividend, did not come to more than -7,5%, which, although is a loss, compares very favourably nationally and internationally.

Bankinter still has one of the best stock market track records in European banking over the last three, five and ten years, demonstrating the confidence investors have in its management and business model. Since the end of 2013, the share price has risen by 41%, while in the same period, the Ibex fell by 14% and the STOXX Europe 600 Banks recorded a fall of 32%.

At year-end 2018, Bankinter, S.A.'s share capital was represented by 898,866,154 fully subscribed and paid shares with a par value of €0.30 each. All the shares are represented by book entries, are listed on the Madrid and Barcelona Stock Exchanges and are traded on the Spanish computerised trading system.

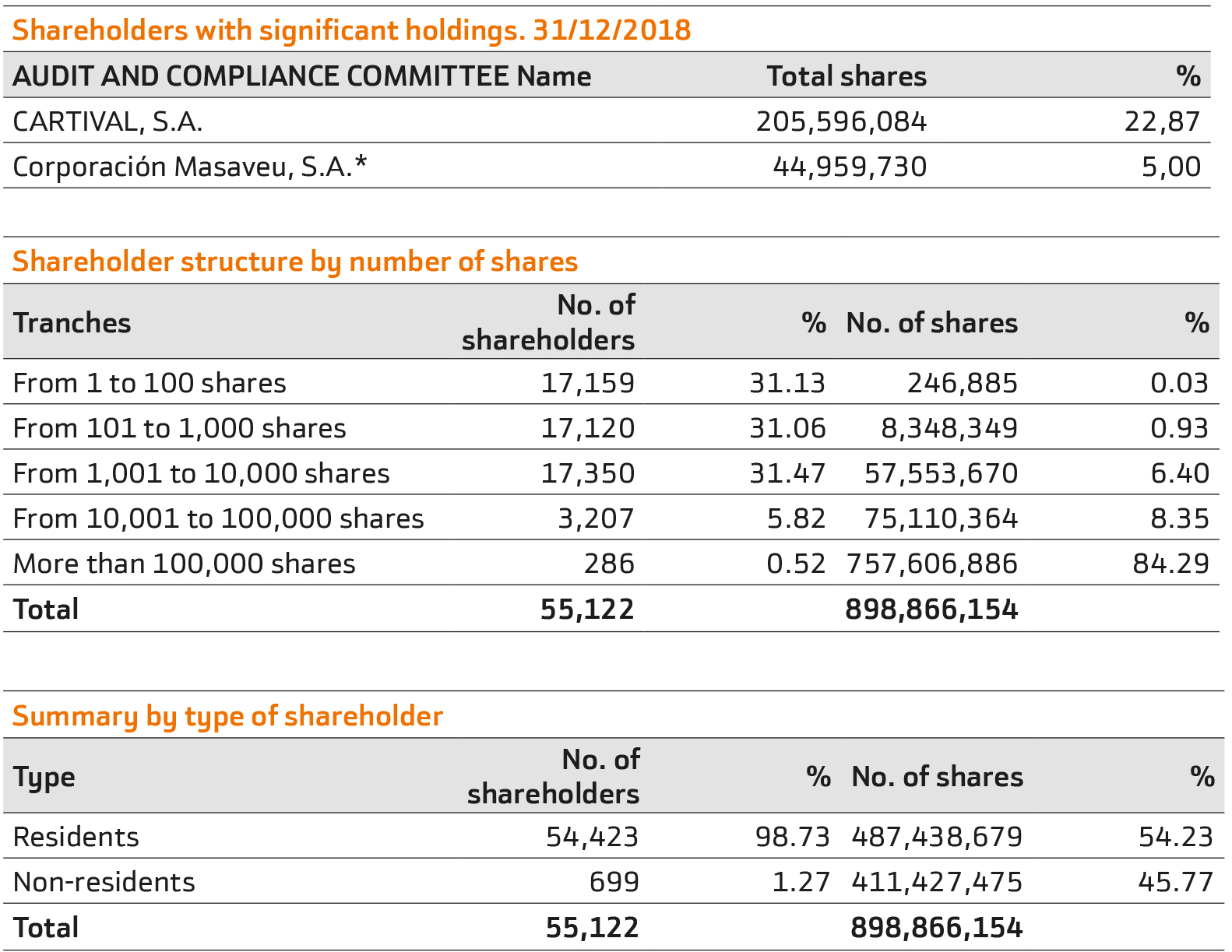

Bankinter had 54,911 shareholders at 31 December. Residents held 54%of the share capital and the remaining 46% was in the hands of non-residents. Registered shareholders who hold more than 5% of the share capital are detailed in the table below. Treasury shares included 99,110 shares.

The most significant figures regarding the Bankinter share in 2018 are detailed in the following tables:

(*) This percentage of Bankinter's share capital owned by Corporación Masaveu is part of the indirect voting rights held on the Bank's share capital by Bankinter director, Mr. Fernando Masaveu. Mr. Fernando Masaveu directly and indirectly holds 5.29% of the voting rights of Bankinter's share capital.

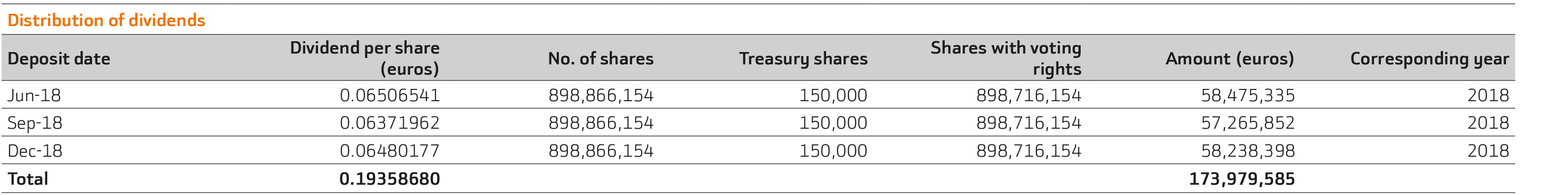

Once again, Bankinter maintained its very stable and distinctive dividend policy, which is traditionally paid quarterly in cash. Both the strong evolution of the business and its high capital adequacy have made it possible to consolidate the high payout (percentage of earnings dedicated to dividends) in recent years, within the recommendations generally released by regulators for the adequate preservation of the banks' capital.

In 2018, as is usually the case, four cash dividends were distributed: a final dividend for 2017 and three interim dividends for 2018, which represented approximately 50% of ordinary profit obtained in the first three quarters. The fourth and final dividend to be paid out of full-year 2018 profit, will be approved at the 2019 Annual General Meeting of shareholders.

Bankinter has a Level 1 ADRs programme managed by Bank of New York-Mellon, which had 106,644 outstanding at 2018 yearend. This enables residents of the United States to invest in foreign companies in a dollar-denominated product and to receive dividend payments in their own currency.

The distribution of dividends for 2018, as of the date of publication of this report, is as follows:

We use our own and third-party cookies to improve our services and show you advertising related to your preferences by analyzing your browsing habits. If you go on surfing, we will consider you accepting its use. You can get more information, or know how to change the configuration in our Cookies Policy. Accept