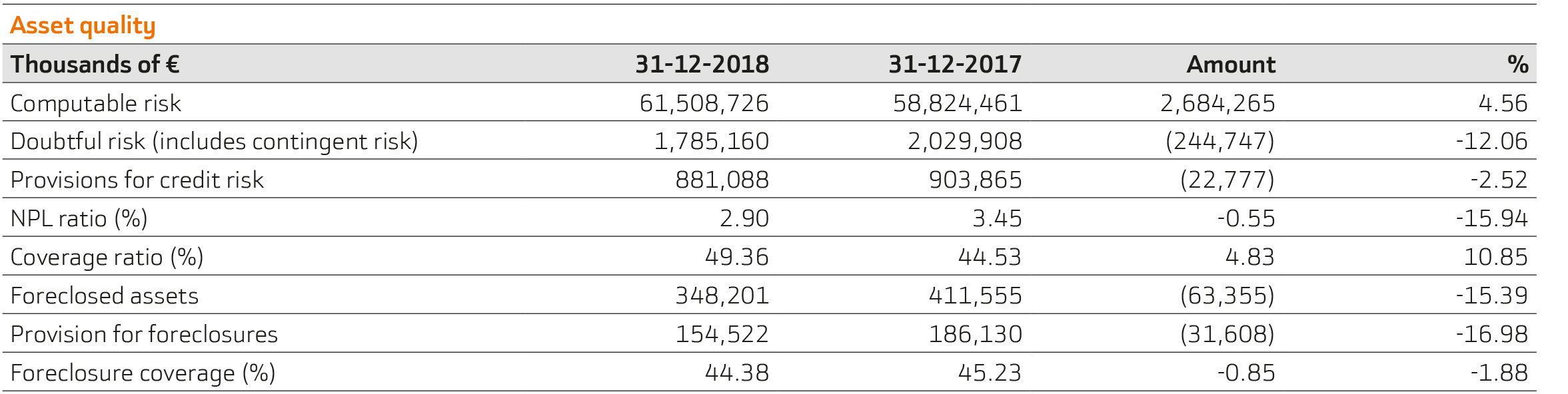

During 2018, the Spanish economy continued in the expansionary phase, although growth slowed down over the course of the year. Internationally, trade tension was evident, there was an increase in political uncertainty in Europe and the dollar appreciated against emerging currencies, causing financial tensions in certain countries. In Spain, the indebtedness of companies and families continued to fall and, in aggregate terms, lending to the private sector was lethargic for the large part. Against this backdrop, Bankinter's trend towards moderate growth remained for another year. Lending to customers grew by 4.1% whilst computable risk (including off-balance-sheet risk) grew by 4.6%. Asset quality continued to improve. Once again, the ratio of problem assets dropped, as can be seen in the following table.

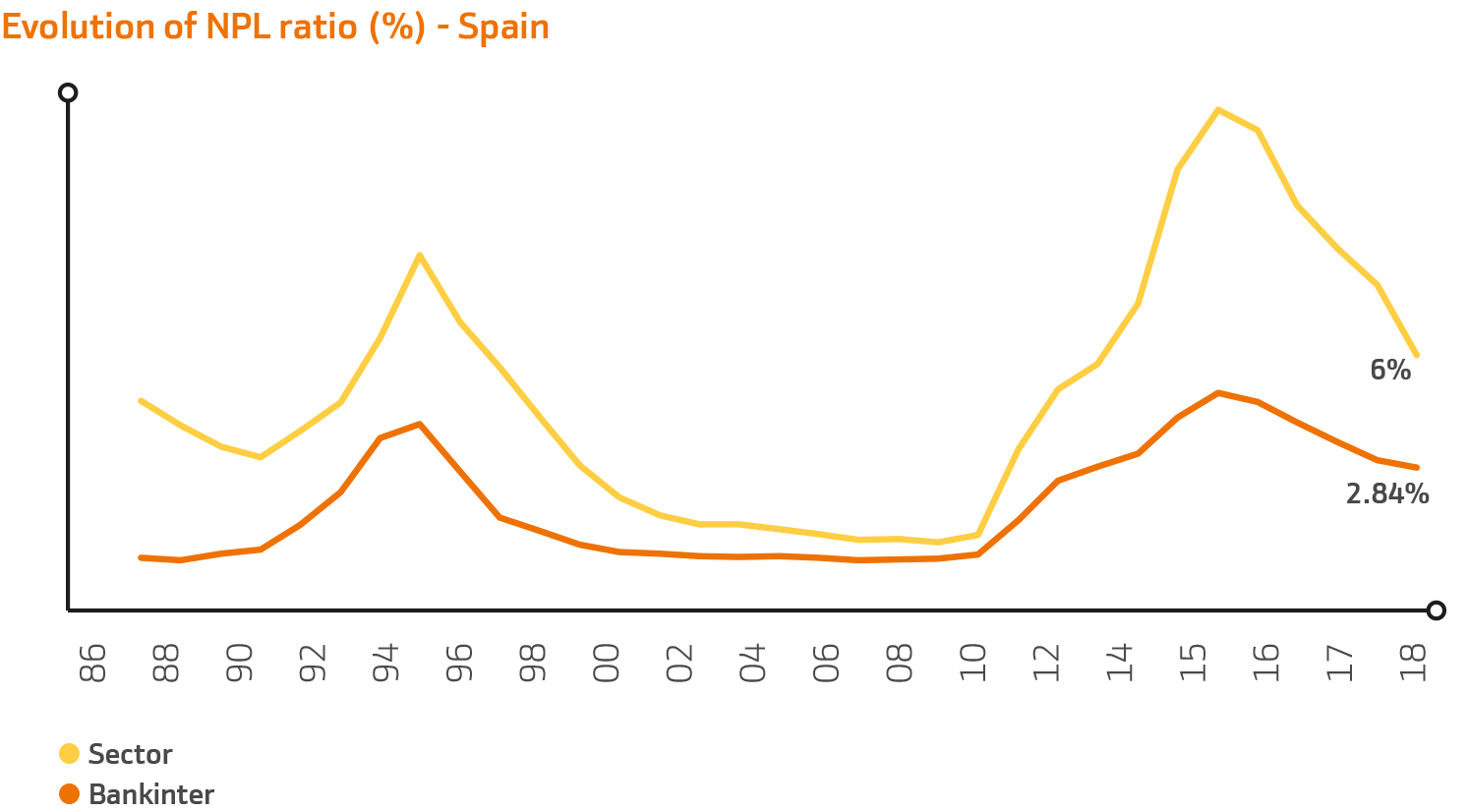

The non-performing loan ratio ended the year at 2.90%, a 55 basis-point or 16% decrease year-on-year. The non-performing loans ratio in Spain at year-end was 2.84%, 47% of the median for the industry (6.08% according to Bank of Spain data from November 2018). At the end of December 2018, the foreclosed asset portfolio was €348 million which was 0.6% of the total credit risk, following a reduction of 15% in the year.

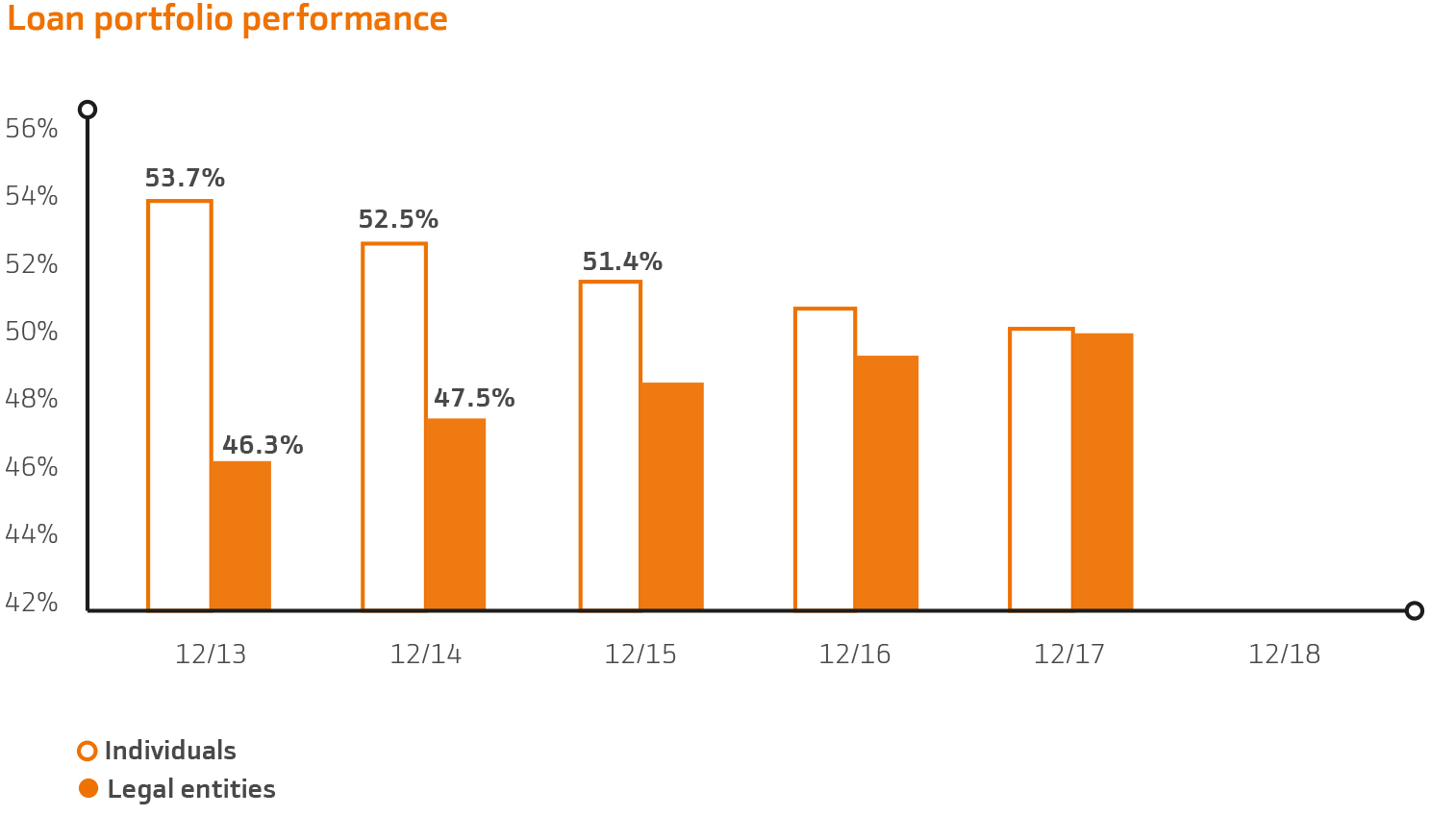

Over the years, Bankinter has tried to balance the distribution of its loan book between individuals and legal entities. At year-end 2018, the computable risk for individuals was 49.9% of the total, and that for legal entities was 50.1%. The most important characteristics are described below by segments:

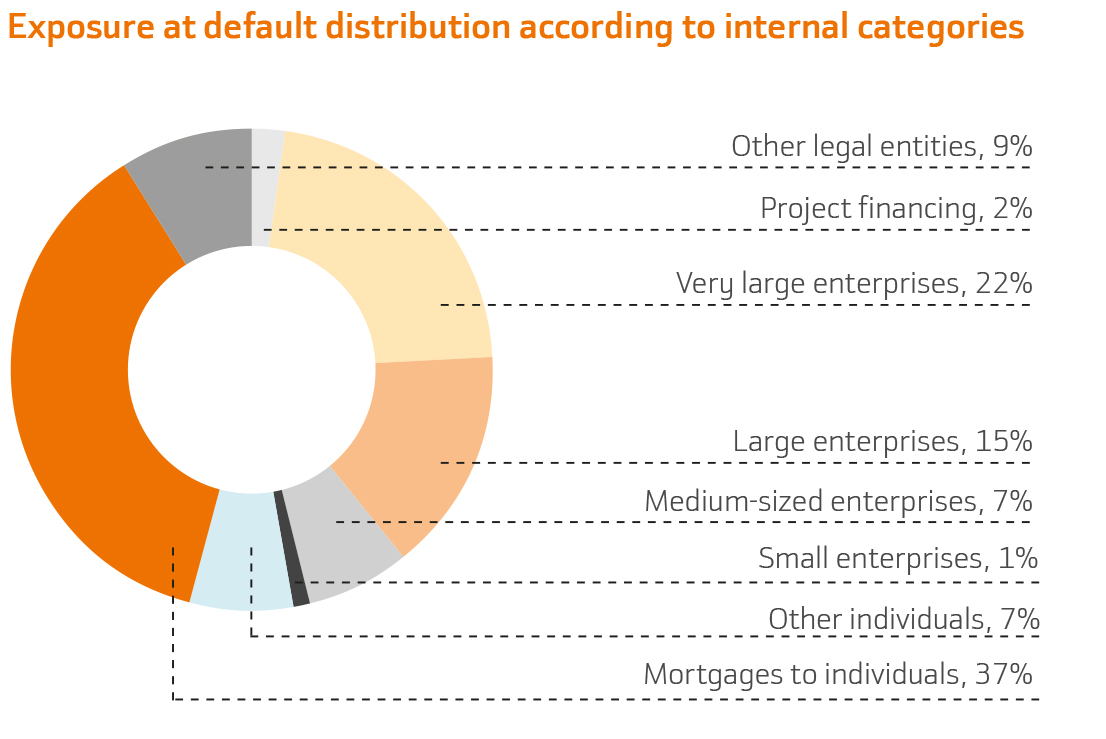

Bankinter has used internal rating models as a tool for supporting its decisions regarding credit risk since the 90s. These models enable the Bank to assess the credit quality or solvency of transactions and customers, providing quantitative measurements of its credit risk. These models are mainly used to support approvals, set prices, quantify the coverage for impairment or provisions, estimating regulatory capital, monitor loan books, support recovery and facilitate active management of the loan books' risk profile.

The internal rating models provide homogeneous classes of solvency and levers that group together customers and transactions with a comparable probability of non-compliance. These models are also calibrated to assess expected and unexpected losses. These metrics are fundamental for managing and monitoring credit risk at Bankinter.

The Bank has rating models both for retail segments (mortgages, consumer spending, SMEs and so on) and wholesale segments, such as Corporate Banking. These statistical models are developed using customer, operational and macroeconomic information, combined in the wholesale segment with expert analysis. The models are updated and monitored on a regular basis to ensure their power of discrimination, stability and accuracy under a strict governance structure. The models committee and the executive risk committee are responsible for approving Bankinter's models. The risk committee also receives information on a regular basis on the status and monitoring of these models.

The distribution of Exposure at Default (EAD) by internal segments or categories is shown in the following graph.

We use our own and third-party cookies to improve our services and show you advertising related to your preferences by analyzing your browsing habits. If you go on surfing, we will consider you accepting its use. You can get more information, or know how to change the configuration in our Cookies Policy. Accept