These programmes are oriented towards improving the bank's performance in relation to its internal and external stakeholders.

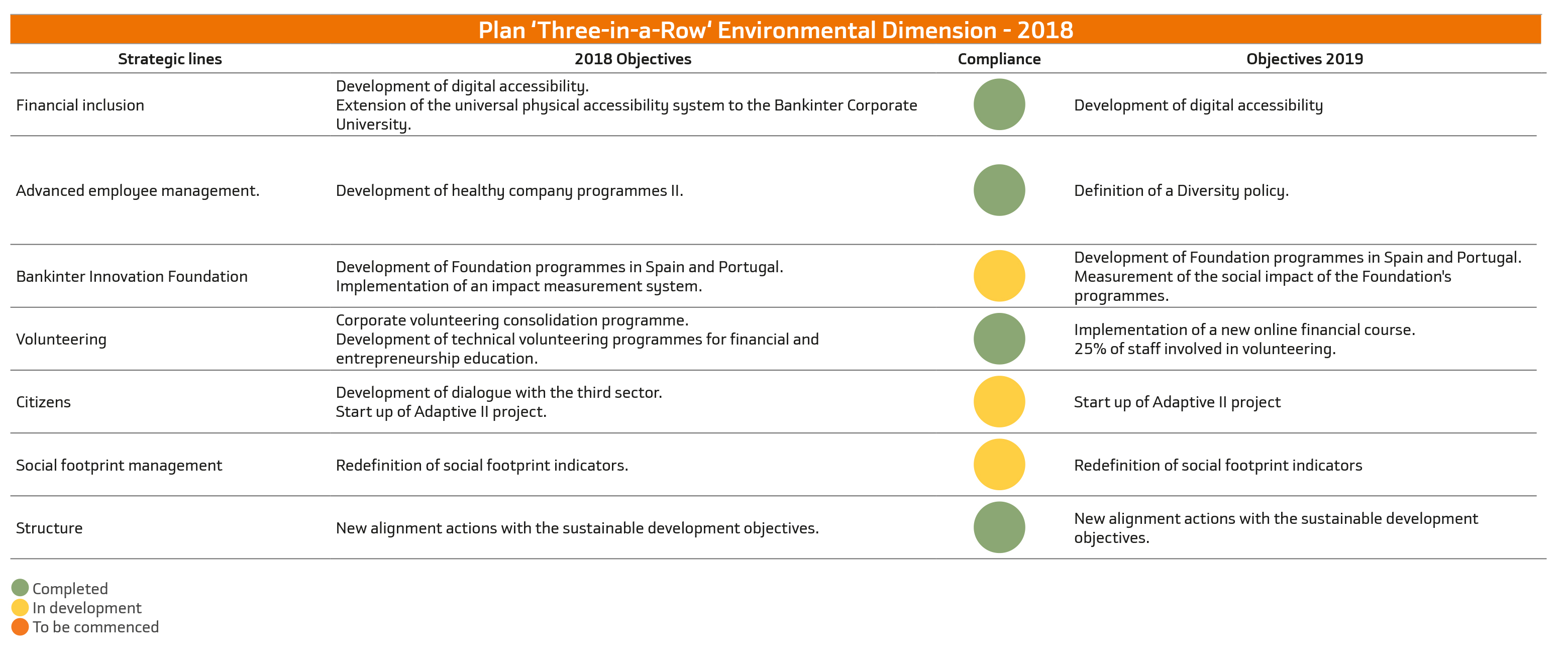

The Bank's inclusive strategy is set out in its A bank for all programme, which reflects its firm commitment to making all its relationship channels with its stakeholders accessible. Bankinter particularly takes into consideration disabled and elderly people by aiming to offer them a quality service adapted to their needs.

The accessibility strategy addresses both physical and digital and cognitive accessibility.

Bankinter has an AENOR-certified Universal Access Management System (UAM), under standard UNE 170001, and it has been implemented in the Bank's headquarters in Madrid, at the Alcobendas building, and in seven branches.

In 2018, the scope of this certification was extended to the Bankinter Corporate University, which is the centre where face-to-face training is imparted to all employees; it is located in Tres Cantos.

In addition, the accessibility criteria included in the works manual were applied in both the remodelled and new branch offices in Spain and Portugal.

In terms of digital accessibility, the objective is that both the contents and the services offered through the Bankinter websites are accessible for all its customers, in line with the recommendations of the World Wide Web Consortium (W3C) through its WACG 2.0 guidelines.

The Bank offers, for example, Braille coordinates card for phone transactions, monthly statements in audio and large print formats, an accessible video player, and the advisory service by video-calls in sign language.

In relation to cognitive accessibility, the bank has made a Clear Finance Dictionary available to customers, developed in collaboration with the Instituto de Empresa, adapting the meanings of the most commonly used banking terms to make them easier for everyone to understand.

The Commercial Protocol for bank employees also includes service guidelines for differently-abled people for each phase of commercial activity.

In addition to complying with regulations on risk prevention and occupational health, Bankinter has a system certified under OHSAS 18001 at its main work centres in Portugal.

To enhance the wellbeing of its employees, both professionally and personally, the bank runs: the Saludablemente programme; Health Week, which includes everything from ergonomics and nutrition courses to advice for getting the most out of physical exercise; and the Summer School, where both training and purely recreational courses are delivered, aimed at acquiring certain skills, promoting health and wellbeing.

In 2018, the Bank was once again awarded the family-responsible company (EFR) seal.

The bank's advanced people management was highlighted in 2018, in surveys conducted by Top Employer, and Merco Talento.

Bankinter has a corporate volunteering portal, Mueve.tewith, which seeks to promote the social and environmental engagement and involvement of the workforce, to undertake activities which have a major environmental impact. This programme also strengthens the organisational culture of the bank and helps participating volunteers to develop new skills.

In 2018, the proportion of the workforce involved in volunteer days rose to 20%. Participation was recorded of over 1,000 employees and their family members in a total of 98 technical, environmental and social activities, reaching a total of 3,481 direct beneficiaries.

Bankinter promotes financial integration through technical volunteering activities in the delivery of financial education programs. Recipient groups to whom this training is imparted includes: individuals with intellectual and/or sensorial disabilities, secondary school and baccalaureate students, young entrepreneurs or people at risk of social exclusion. Such initiatives help to develop specific employee skills, such as having adapting communications to everybody, regardless of their abilities and knowledge.

The following activities stood out in 2018:

Participation in the 4th edition of the Tus finanzas, tu futuro programme, promoted by the Spanish Banking Association (AEB), in cooperation with the Junior Achievement Foundation. Its mission is to develop the skills and knowledge of secondary school and baccalaureate students on managing domestic economy.

Bankinter customised financial education programme. In 2018, out was rolled out to groups at risk of social exclusion from the Integra Foundation and people with disabilities from the A LA PAR Foundation.

Financial Education Programme Lifetime Accounts. Imparted in Portugal to beneficiaries of the Centro Educativo Caxias and the ‘Ajuda de Mãe’ Association.

High impact technical volunteering programme, in collaboration with the Harambee Foundation. Developed at Strathmore University (Nairobi, Kenya), the aim of which is to provide value in the form of risk management knowledge at financial institutions. Participating volunteers were also offered a unique, enriching experience for the development of senior management leadership at the bank.

Mentoring programme. targeted at students with learning disabilities in the CAMPUS Project of the A LA PAR Foundation, in order to develop their skills and facilitate their social and occupational integration.

Brazo Directo programme, with the Junior Achievement Portugal Foundation. This initiative allows young people to experience the real business world by taking them to one of the Bank's workplaces for a day.

Innovation Challenge programme, with the Junior Achievement Portugal Foundation. This initiative asks students to solve a problem based on a real situation from the business world.

In the communities in which it operates, Bankinter establishes strategic alliances with voluntary organisations, receiving support from them to identify and responds to local needs.

As a member of the United Nations Global Compact Network Spain, Bankinter assumes the commitment to incorporate its ten principles into the Bank's business activities.

Bankinter is a promoting partner of the Lealtad Foundation, a non-profit institution whose objective is to provide accreditation for associations and foundations involved in social action, development cooperation and humanitarian action that comply with the nine transparency and good practice principles.

The Bank has also served on the Governing Board of Forética, a leading association of companies that promotes corporate social responsibility and sustainability in Spain and Latin America.

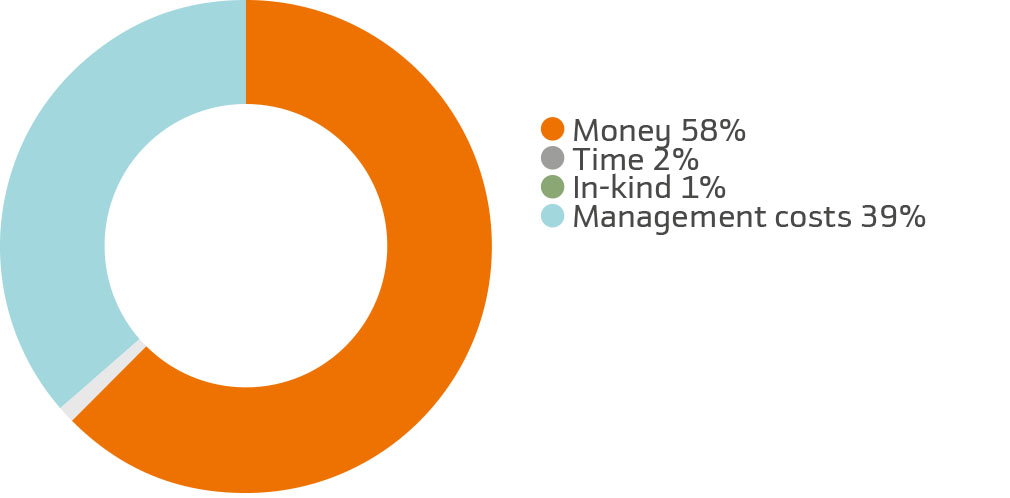

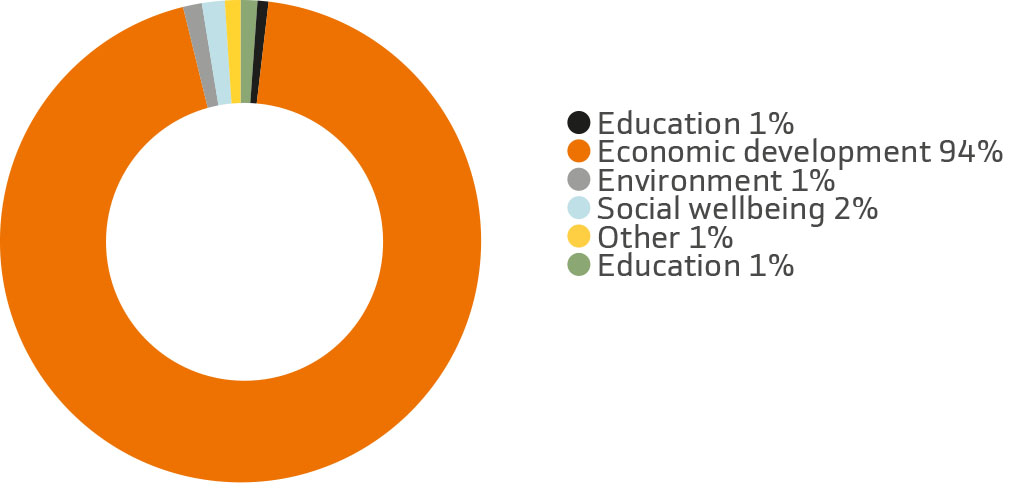

In order to improve the effectiveness of its social endeavours, the entity has adopted the methodology developed by the London Benchmarking Group (LBG) which measures, manages, assesses and disseminates the Bank's contributions, achievements and impact of social action in the community and in the environment.

To support the work of voluntary associations, Bankinter develops products and services for charitable purposes that it makes available. It offers the Bankinter Solidarity Card (with the corresponding fees donated to social projects as part of the Involvement and Solidarity programme) and the Bizum Solidario service,to facilitates micro-donations made using mobile phones.

Starting in 2018, Bankinter provides its customers with access to the Inuit social impact fund, a collective social investment vehicle.

As they are a significant stakeholder, the Bank has strengthened its support for entrepreneurs, as the engine for revitalising the economy and a long-term source of job creation and wealth. In addition to the Entrepreneurs programme developed by the Foundation, it has supported the following initiatives:

Collaboration programme with SECOT (Spanish Seniors for Technical Cooperation) on a platform for both retired and active executives to enable them to convey their knowledge on a voluntary and altruistic basis to innovative entrepreneurs and microenterprises through training programmes.

Involvement in the organisation twelfth edition of the Mashumano Youth Awards, recognising those entrepreneurs who provide innovative, sustainable and socially responsible solutions. Specifically, Bankinter sponsored the Best solution for helping to integrate differently abled people category, taking part in the processes of selection, training and financing of the winner.

Financing of support workshops for young entrepreneurs with environmental impact initiatives, organised by the startup Greenweekend, with five events held in 2018, as meeting points for green entrepreneurship.

Collaboration agreement with the Integra Foundation to deliver workshops on financial education and social and occupational inclusion.

European Pro Bono and Skills-Based Volunteering Summit 2018, the biggest corporate volunteering event in, held at Bankinter's head office in Madrid, organised by the Hazloposible Foundation. The meeting brought together experts and leaders from the Pro Bono movement and professional volunteering from around the world

The following are some of the other solidarity initiatives carried out in 2018:

Holding of the seventh edition of the Involvement and Solidarity programme. A 360º initiative through which ten social projects are being financed, with the sum received from fees relating to the Bankinter Solidarios card. It involves various of the Bank's stakeholder groups: customers, who use the Bankinter Solidarity Visa; more than 1,200 employees, who submitted 150 social projects; society, which participates in and disseminates the project in the social networks; and the Bank's executives, who act as sponsor or ‘godfather’ to the projects.

Financing of the COCEMFE employee portal which in 2017 enabled the integration of women with disabilities into the workforce.

Organisation of the Bankinter Portugal Social Awards to recognise initiatives with a high social impact in Portugal.

The fourth edition of the Innovation, Sustainability and Network Awards organised with Expansión and Viesgo, and with the technical advice of the IE Business School. Recognising the most outstanding projects by large and mediumsized companies and institutions that contain aspects of social and environmental responsibility.

Development of the A Smile for Christmas campaign to collect new toys among employees, organised by Cooperación Internacional, a NGO providing for over 10.304 children in centres and associations for poor families throughout Spain.

The Bank is sponsor of the Bankinter Innovation Foundation, which promotes innovation and entrepreneurship as the driving forces in creating sustainable wealth in Spain and Portugal.

We use our own and third-party cookies to improve our services and show you advertising related to your preferences by analyzing your browsing habits. If you go on surfing, we will consider you accepting its use. You can get more information, or know how to change the configuration in our Cookies Policy. Accept