The institution's Environmental Policy is aimed at enhancing the positive impacts and minimising the negative effects of its activity on the environment.

The Sustainability Area is responsible for ensuring compliance with the policy's principles and ensuring the bank's commitment to protecting the environment.

It has also set up an Environmental working group with the areas most involved, which periodically monitors the progress of the environmental indicators and the implementation and development of the environmental management system.

The environmental dimension includes the Climate change strategy and its Carbon footprint project, through which the direct and indirect environmental impacts generated by the Bank's activity are identified, measured and controlled.

The environmental criteria are present in the Bank's investment and financing policies. At the end of 2016 Bankinter adhered to the Equator Principles, whereby environmental and social analyses are carried out on all financing projects which require them. The financial sector guides defined in 2018 also include environmental and social criteria to be analysed in transactions.

The chain of suppliers and subcontracts are not exempt from responsible environmental management: prior to their approval, environmental criteria are taken into account and environmental clauses are included in contracts where risk is considered to be greatest.

The bank collaborates with leading organisations which assess and evaluate its environmental performance, such as the Carbon Disclosure Project (CDP), of which Bankinter has been a signatory company from the beginning. The entity is also a member of the CDP Water and CDP Forest Disclosure projects.

Bankinter's Climate Change Strategy has a good rating in the sustainability indexes, although the bank is aware that the expectations of its stakeholders in this regard are increasing. In anticipation of the new Climate Change Law, we are already analysing the implications of the recommendations of the Financial Stability Board and the Task Force on Climate-related Financial Disclosures, which indicate that financial institutions need to manage climate change risks and opportunities in the short, medium and long term.

Bankinter is in the process of defining a strategy that incorporates these recommendations, based on the important work already performed and short, medium and long term objectives are being established with the areas of the bank that are most involved (risks, investment banking, asset management, etc.)

In the challenge that climate change raises, every actor must identify their role. And although the financial sector is not a carbonintensive industry, the financial institutions have a major role in the transition to a lowcarbon economy.

Therefore, the Bank's responsibility to the environment dos not rest so much in managing the direct impact of its activity on its surroundings (something which it has been managing for over a decade), but rather in its identification and management of its indirect impact, in other words, that which is created by the application of its financing and lending policies.

Bankinter, as part of its Climate Change Strategy, has defined a road map for itself to become carbon neutral that includes formulas both for the reduction of emissions through eco-efficiency programmes, and for neutralisation (green energy purchase), and offsetting (indirect purchase of carbon rights for reforestation and conservation projects).

At the same time it is working on identifying its indirect impacts, that is, in ascertaining its actual contribution to climate change and the loss of biodiversity.

In this connection, Bankinter has been the Spanish leader of a pilot project in collaboration with the Natural Capital Coalition, an initiative promoted by the United Nations Environment Program. Its objective is to develop a specific guide for the financial sector that facilitates the identification and management of impacts on natural capital: the guide for the financial sector of the Natural Capital Protocol. This project will seeks to reveal:

The conclusions reached as part of this undertaking have helped the bank to establish the first financing sector guidelines, including ESG criteria for the mining, agriculture and defence industries.

Bankinter's new building in Alcobendas (Madrid), was certified under LEED (Leadership in Energy and Environmental Design) in 2018 at its Platinum level (maximum certification).

This is a sustainable, innovative and eco-efficient building following the latest trends in the ‘office of the future’, as the most innovative workspaces are known.

It adapts to the Bank's commitment to sustainability and it meets strict criteria for energy efficiency and healthier work environments.

Not only is it subject to water and energy saving measures, 90% of workstations have natural light, something which is not commonplace in big buildings in Madrid.

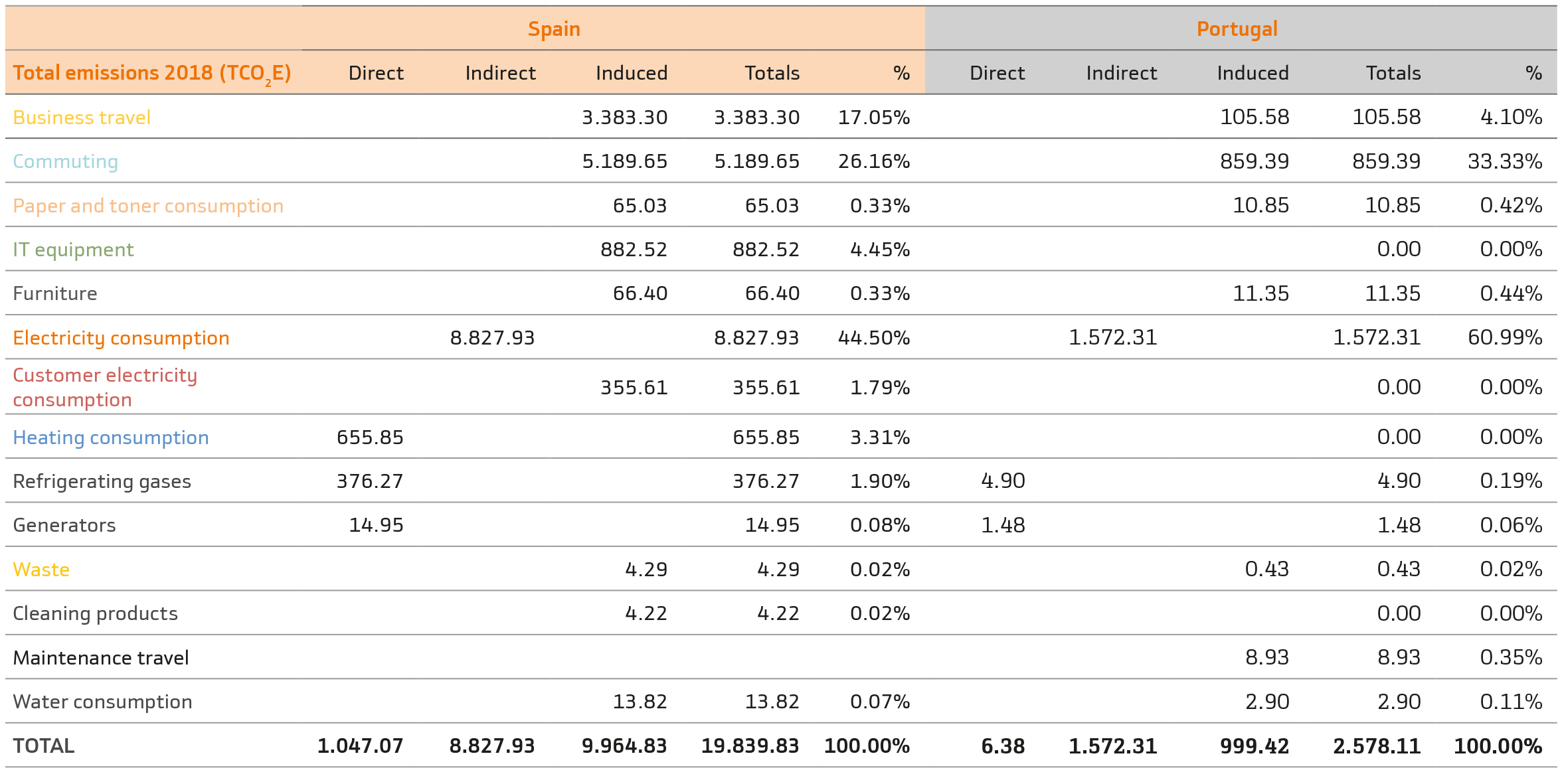

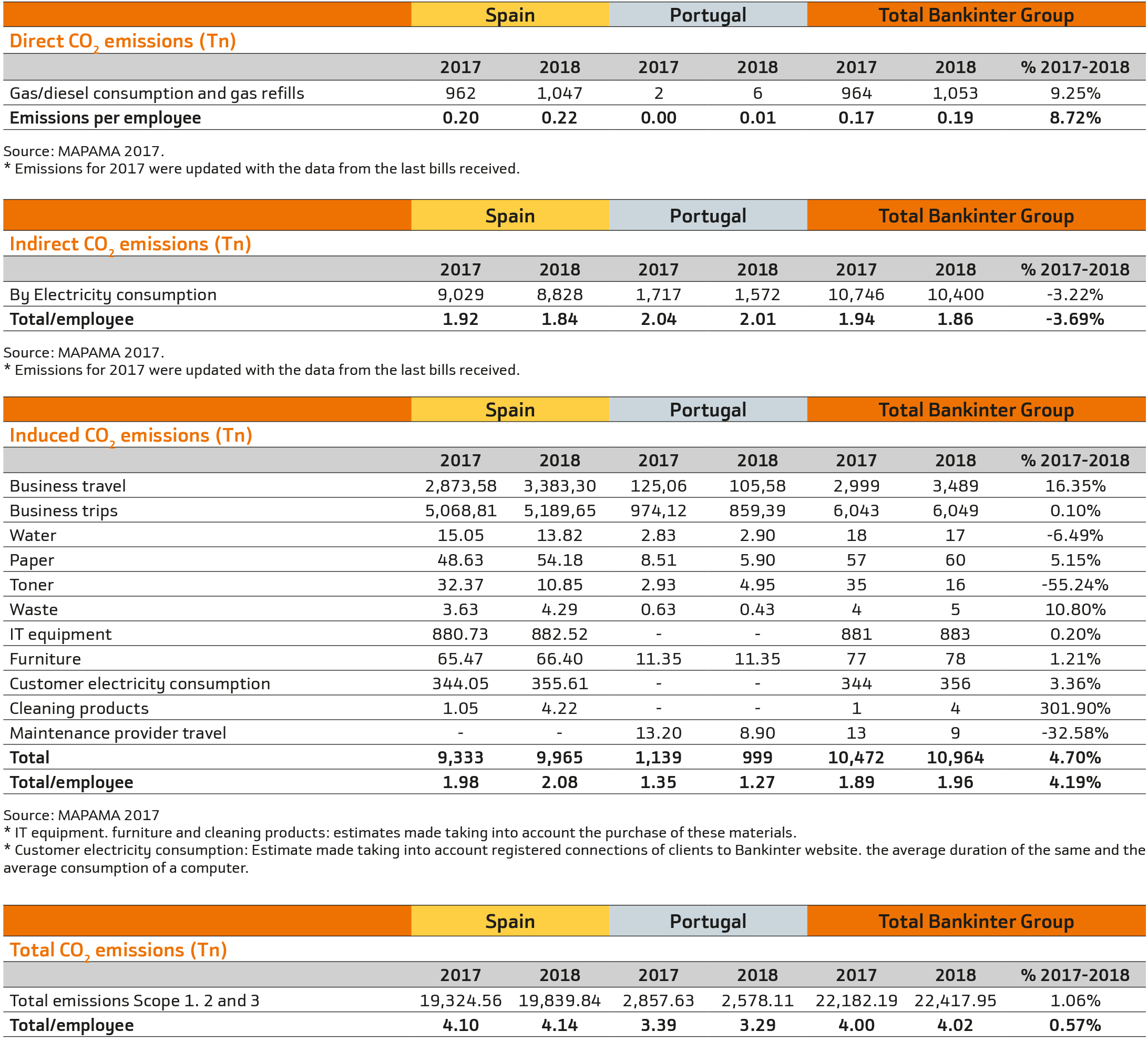

Bankinter has been calculating its overall carbon footprint since 2009 in its three emission ranges: direct (consumption of fossil fuels and possible leakage of refrigerant gases), indirect (electricity consumption) and induced (travel and paper consumption, among other impacts).

In 2018, the Bank's calculation of its organisational carbon footprint, this time including the business in Portugal, was once again verified by an external company, SGS, in accordance with the Greenhouse Gas Protocol and in line with the requirements of the Intergovernmental Panel on Climate Change.

Bankinter once against registered its carbon footprint (calculated in 2017) with the Carbon Footprint Registry of the Ministry of the Environment.

In 2018, Bankinter's business in Spain and Portugal produced a total of 22,417.95 tonnes of CO2 equivalent, 4.02 tonnes CO2/per employee (down 0.56% on 2017)

Scope 1 (direct) emissions totalled 1053 tonnes of CO2 in Spain. This is a 9.25% increase on 2015 in absolute terms and a 8.72% increase in terms of emissions per employee. This increase in emissions can be attributed, for the large part, to operations throughout 2018 in the new Alcobendas building, whilst in 2017, it was only in operation for a few months.

In scope 2 (indirect emissions), there was a decrease of 3.22% in absolute terms and 3.69% in emissions per employee.

Total scope 1 and 2 emissions per employee fell by 2.66% compared to 2017, thanks to the various energy efficiency measures implemented in recent years, the controls established and that in 2018, electricity at the new Alcobendas building has been provided by renewable energy.

Scope 3 emissions, induced emissions, increased by 4,70% (4.19% per employee), mainly due to the rise in business trips due to increased commercial activity, in line with the financial results presented by the Bank in 2018.

The company has identified the main ecoefficiency indicators of its activity to be measured and controlled. The purpose of this is to implement all necessary measures to ensure optimum environmental performance. This means minimising its carbon footprint and in the strategy for mitigating climate change.

2018 was the first year in which the Alcobendas 14 building was fully operational (in 2017, it was only operational for six months), meaning that the trends of some indicators, most importantly natural gas consumption, were affected. It is expected that in 2019, when the building will be fully operational, there will be a return to the normal downward trend of all the environmental indicators.

Indirect energy consumption by the Bank is from electricity consumption. This is the main source used by Bankinter (89% of total energy consumed) and its consumption has gradually been reduced in recent years as a result of the efficiency measures adopted. In 2018, total electricity consumption has decreased by 1.72% (even taking into account operations at the new Alcobendas building)

In terms of direct energy consumption (diesel and natural gas), the trend in 2018 has been affected to a large extent by natural gas consumption at the new Alcobendas building. In total, this consumption has increased by 64% year-on-year. However, the Group's total energy consumption in Spain and Portugal has only increased by 2.11% per employee, compared to 2017.

At year-end 2016, energy audits were carried out at the Bank's buildings as required under prevailing legislation to assess the energy management carried out so far (upgrade of equipment to more efficient models, replacement of lightbulbs with LEDs, remote management of consumption, etc.)

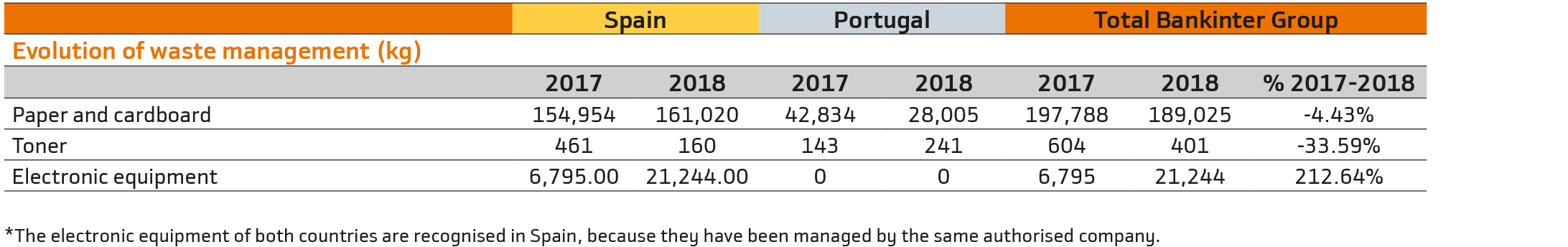

Bankinter acquires paper according to demanding environmental criteria. It is 100% recycled and bears the Blue Angel and Nordic Swan ecolabels.

To reduce its consumption, the bank has implemented measures such as the biometric signature solution, which is now used at fixed positions in branch offices and which has been extended in recent years to various operations and (investment fund agreements, current accounts, deposits, pension plans). Tablets have been distributed among office employees so that clients can carry out operations with a digital signature.

Another important milestone was the digitalisation of the recruitment process. As well as the digital signature of the contract, all the documentation associated with each employee goes to forms part of a personal digital archive, thereby reducing the paper requirements.

In addition, customer information campaigns have been maintained to replace paper correspondence receipt with the web correspondence model .

To guarantee the continuous improvement of its environmental performance, Bankinter has an environmental management system (EMS), certified according to the UNE EN ISO 14001 standard. This system has been adapted to the most recent version of the standard and its scope expanded to include the new Alcobendas building. It currently includes the Banks four landmark buildings in Madrid (Paseo de la Castellana, Tres Cantos, the two buildings in Alcobendas), and a branch office. The Internal Audit team participated in its annual verification process.

In Spain, 42% of the bank's staff is covered by this environmental certification. Portugal too has a certified environmental management system, which in 2017 saw its scope extended to include the new headquarters in Marqués de Pombal, Lisbon (it also includes the Torre Oriente building) and covers 45% of the workforce.

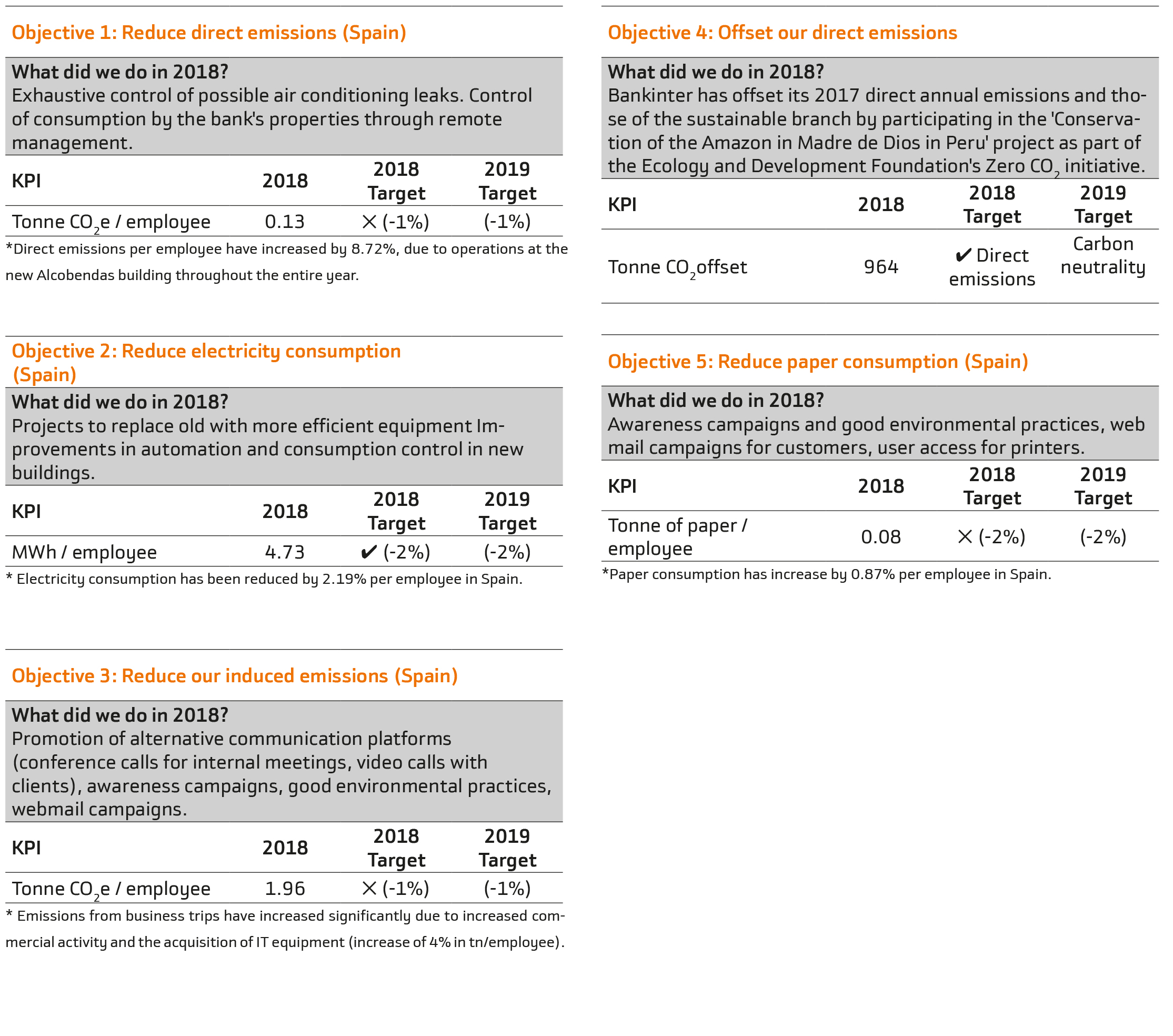

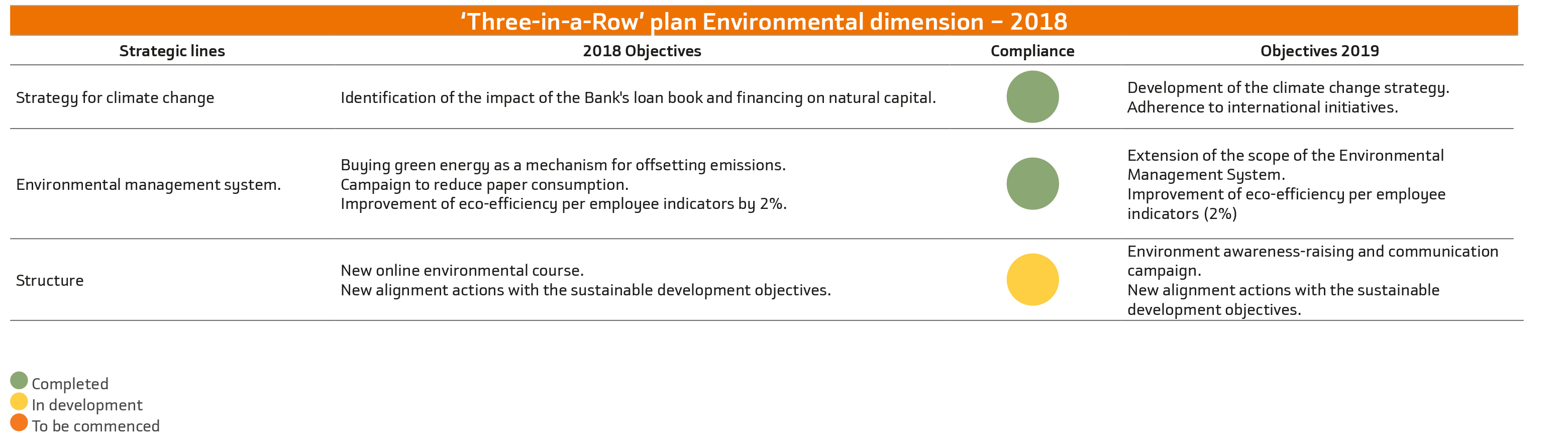

In its annual environmental management programme, Bankinter includes a series of objectives and goals aimed at optimising consumption and correct waste management; the reduction of emissions to the atmosphere and the programming of communication campaigns, awarenessraising and training of employees on good environmental practices. These are detailed below:

The Bank has different communication channels, both internal and external, for the dissemination of its various social and environmental initiatives, through which it promotes the participation of all its stakeholders.

In addition to this annual report, the environmental portal and the blog, which offers opinion, reflection and debate between all employees, are also available.

Among the awareness-raising actions targeted at the workforce are the following:

Environmental website. It provides the entity's staff with news about activities of environmental interest, both internal and external to the bank. It also provides the employee with a suggestion box.

Sustainability section in the Bankinter blog. This is an independent section whose publications are also disseminated through the Bank's Social Networks (Facebook, Twitter, Linkedin and Google+).

Collaboration in and financing of workshops in support of young green entrepreneurs, organised by the startup Greenweekend. In 2018, Bankinter collaborated in five events.

XIV edition of the Environmental Photography Awards. Held in 2018 under the slogan Tree hunters and attracted entries from employees from Spain and Portugal.

Presentation of the climate change strategy at different forums.Bankinter played host to the Correspondent Bank Alliances and Environment Workshop and participated at different workshops, including those organised by Vozpópuli and the Ecogestiona environment and corporate radio program.

Supported the Earth Hour campaign, a WWF initiative to reduce CO2emissions. To support it, the lighting of all the properties of the bank was turned off and different devices were disconnected. The participation of employees and customers was also encouraged.

Eco-efficiency Prize in Portugal,a competition where employees suggest their ideas for internal eco-efficiency.

Bankinter has formed part of the Climate Change Cluster that promotes WBCSD (World Business Council for Sustainable Development) as a leading company. It forms part of the cluster of more than 60 companies from various sectors. Over the course of 2018, the Group explored the management of risks and opportunities resulting from climate change in more depth.

We use our own and third-party cookies to improve our services and show you advertising related to your preferences by analyzing your browsing habits. If you go on surfing, we will consider you accepting its use. You can get more information, or know how to change the configuration in our Cookies Policy. Accept