- Milestones

- Interviews

- Summary of the year

- Results

- Corporate governance

- Risks

- Businesses

- Other businesses

- Networks and channels

- Customer relations

- Digital Banking and omnichannel banking

- Bankinter Innovation Foundation

- People

- Sustainability

- Suppliers

- Brand

- Awards and Recognition

- Appendix

- GRI Content Index

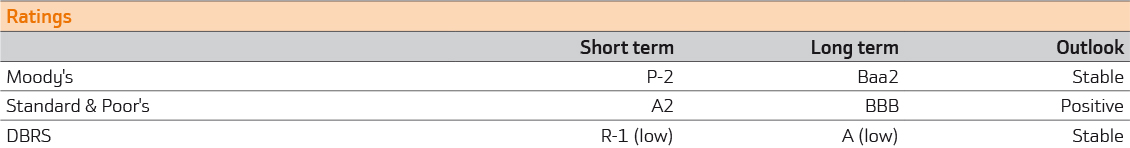

The changes in the Bank's ratings in 2017 were as follows:

The changes in the Bank's ratings in 2017 were as follows: