Private banking

An excellent service and increasingly global

Bankinter's efforts to build a long-term relationship with its customers, based on the excellence of the service it provides and an increasingly global offer, once again saw the private banking segment obtain very good results.

Bankinter's efforts to build a long-term relationship with its customers, based on the excellence of the service it provides and an increasingly global offer, once again saw the private banking segment obtain very good results.

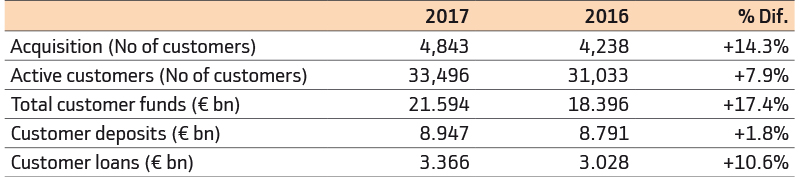

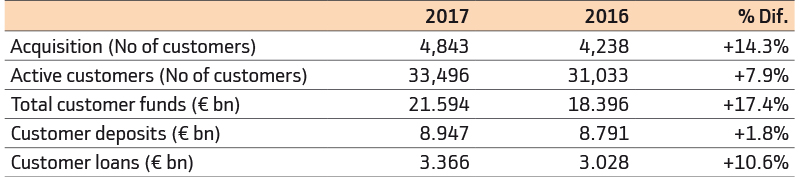

The assets it manages grew by 12%, to reach 35 billion euros, consolidating Bankinter's position as the sector leader in this regard.

Special mention should be made of the performance of investment funds, whose assets increased by 1.8 billion euros, thanks to an open architecture which allows customers to choose from a wide range of domestic and foreign fund managers. In 2017, the Bank has taken a substantial leap forward in the high net worth segment, which provides personalised services that are unique to each customer, with an increase in assets of 1.38 billion.

One of the main new developments in private banking in 2017 was the launch of the Helia Renovables venture capital fund from PleniumPartners, an international group specialising in these types of energy assets, in which our customers invested 222 million euros.

The initiative, which was well received by customers, falls within the framework of Bankinter's strategy of offering alternative investments, with a significant coupon, where the Bank co-invests with customers, in a climate characterised by low interest rates.

Also during the year, a new high-quality and simple reporting system was designed for our customers, which is fundamental to providing an excellent service. Investment has been made in improving the tools used in Bankinter asset management and in the Bank for better customer management, which is more agile and enables us to automatically control risks relating to the portfolios.

Similarly, and in anticipation of the new MiFID 2 regulations, a provision of timely advice has been made available to the entire private banking team for our high net worth customers.

The importance of the team

Another of the pillars of private banking is the financial and tax advisory service, provided by highly-qualified professionals who are subject to a process of continuous training, which has made Bankinter a benchmark entity in this business.

The objectives for 2018 include continuing to make use of digital technology to improve the tools for optimising service quality, devising new investment vehicles that satisfy customer demand and extending the financing product range.

This, along with the high-level of qualifications and commitment of our teams, allows us to keep growing our market share and become an increasingly established sector banchmark, offering our customers a high-value service.

Bankinter's efforts to build a long-term relationship with its customers, based on the excellence of the service it provides and an increasingly global offer, once again saw the private banking segment obtain very good results.

Bankinter's efforts to build a long-term relationship with its customers, based on the excellence of the service it provides and an increasingly global offer, once again saw the private banking segment obtain very good results.