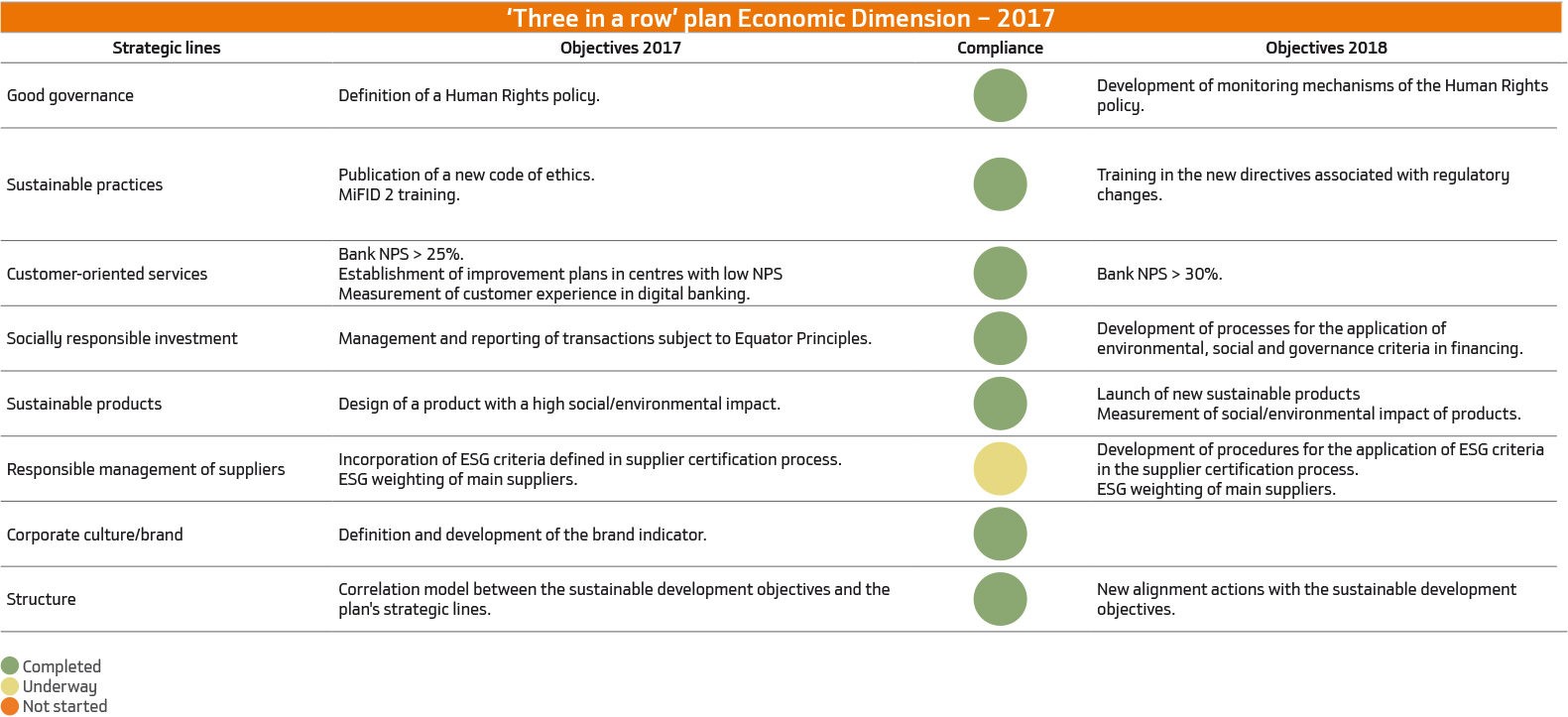

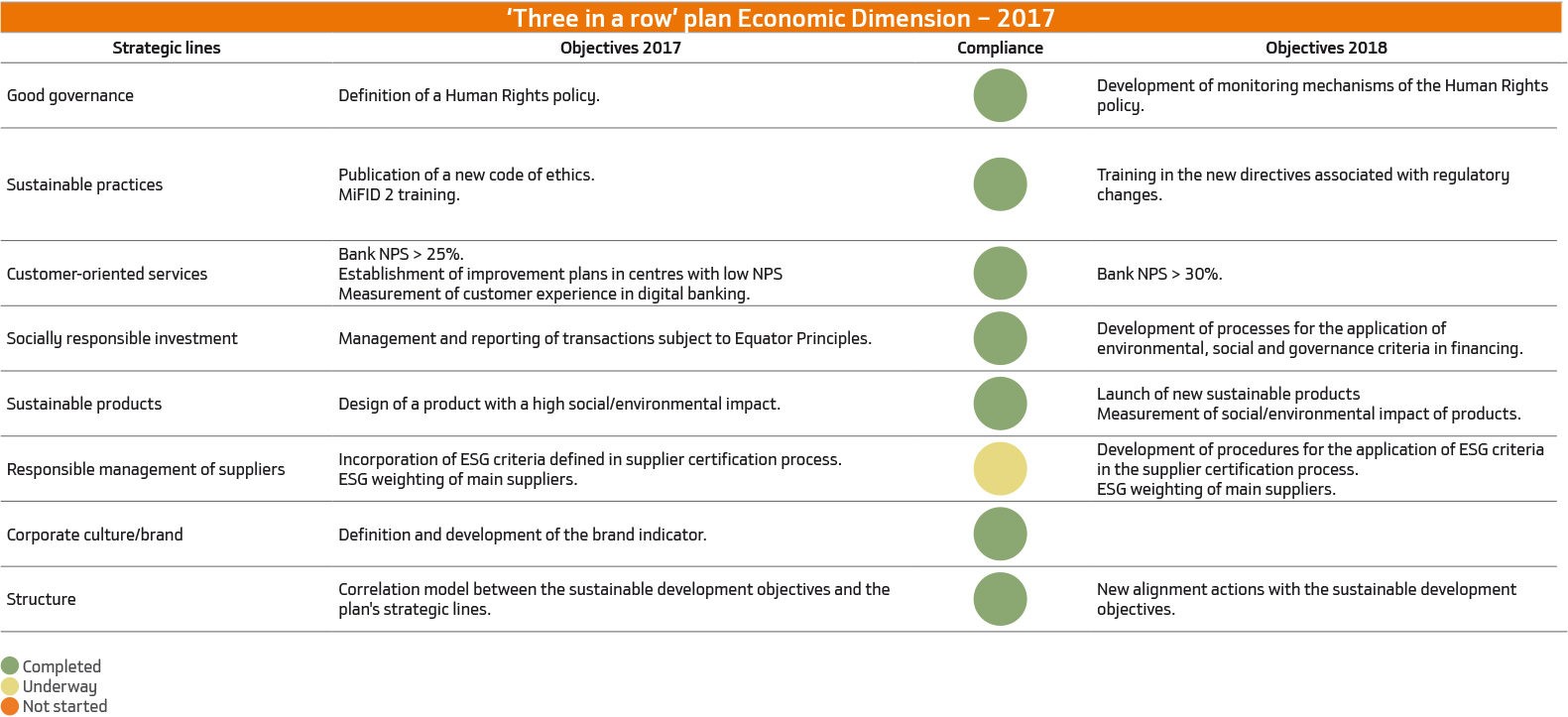

Economic dimension

The Bank's sustainability management was recognised in 2017, with its inclusion on the Dow Jones Sustainability Index Europe, as one of the top ten European banks in terms of corporate governance and environmental and social performance.

The Bank also appears in the rest of the sustainability indexes, including the FTSE4Good, MSCI and Carbon Disclosure Project, and it appears in the Sustainability Yearbook published by RobecoSAM, which was presented at the World Economic Forum in Davos.

In addition to exercising direct control over social action and environmental management, the Sustainability Division also acts as an observatory of trends and risks based on the dialogue it holds with stakeholders. This allows it to discover their expectations and identify the needs of an ever changing environment, and, where appropriate, to consider or integrate them into the sustainability strategy.

Similarly, it promotes the coordinated action of the business areas to develop initiatives focused on responding to these needs; proposing and monitoring the programmes contained in the strategic plan, verifying the degree of compliance with the objectives set for them and identifying areas for improvement, according to recognised ethics and sustainability standards and indexes.

Good governance

The chapter on corporate governance includes considerable information on the size and composition of the board, selection of members and diversity, succession plans and so on.

Of particular note in 2017 was the establishment of a corporate governance policy which contains the general principles that underpin the specific corporate policies and internal rules and procedures in relation to corporate governance, which together form the Group’s internal corporate governance framework.

Bankinter Group also circulated its Human Rights policy, which includes its commitment to respecting, supporting and protecting human rights when carrying out its activities and in relation to its stakeholders in the environment in which it operates: employees, customers, suppliers and other commercial partners, under the UN motto ‘protect, respect and remedy’.

The bank has also become a member, along with other large Spanish companies, of the Cluster of Transparency, Good Governance and Integrity, a platform of companies coordinated by Forética, the leading association of CSR companies and professionals in Spain.

In relation to the management of non-financial aspects of the Bank, the board of directors is the competent body for establishing and overseeing compliance with the sustainability policy and its instruments of implementation, and to decided on any modifications that should prove necessary.

The board's appointments and corporate governance committee is responsible for monitoring the implementation of this policy.

The sustainability committee is the body responsible for proposing and implementing the ‘Three in a row’ plan. It is headed by the Bank's chairman and comprises the executives from those areas directly involved in the development of the plan's strategic lines, who are responsible for implementing them in a way that is coherent and integrated with the Bank's global strategy.

The Internal Audit area is responsible for supervision of non-financial information that is reported, including that which is presented, at least once a year, to the board of directors.

Sustainable practices

In 2017, the Bankinter Group's Code of Professional Ethics was renewed and a new Code of Professional Ethics for the Bank's agent network was introduced.

Customer-oriented services

This line includes service quality and customer satisfaction management. The main indicator that measures this management, the NPS, comfortably beat the target set for 2017, reaching 30%.

Socially responsible investment

This line covers the investment that incorporates environmental, social and governance criteria to those which are strictly financial.

The Bank adhered to the Equator Principles, a leading international initiative in the financial sector with the objective of evaluating and managing the environmental and social risks of the projects to be financed. In 2017, no project subject to these principles was financed.

Bankinter undertakes to evaluate the practices in environmental, social and human rights issues, and to act in accordance with the principles established in its policies, in the due diligence processes carried out prior to entering into financing agreements or any other type of contract and within the framework of the Equator Principles and the environmental and social risk management policies.

The promotion of energy sources that are sustainable, competitive and safe is a key objective for Bankinter's financing. Over the course of 2017, the Bank took part in renewable energy projects (photovoltaic and wind energy, among others), with total financing amounting to 228.5 million euros.

Sustainable products

These are products that incorporate various attributes of sustainability in their design.

The main sustainable products and investments were as follows:

Bankinter Sustainability Fund. It invests in equities that are on the main social and environmental responsibility indexes. It provided a yield in 2017 of 6.2% and had assets of 86.3 million euros (76.7 million euros in 2016)

Responsible investment funds. The Bank makes available to its customers 100 funds of international prestige that invest with responsible criteria. Their investment strategies centre on companies dedicated to renewable energies, innovation and technology, and reduction of the impact of climate change, or that are present in the main sustainability indices.

Investments in venture capital funds or companies that invest in sustainable products. Stakes were held such as the 4.3% and 4.6% in Ysios Biofund I and II (biotechnology and life sciences), 10% in Going Green (electric automotion) and 2.5% in CPE Private Equity LP (clean technologies).

SME Initiative. In the last quarter of 2015 Bankinter and the European Investment Fund signed their third agreement, of which 64 million euros are still available. The Bank provides financing of up to 300,000 euros to companies that are eligible, under highly advantageous conditions, thanks to the guarantee under which it will receive 50% of the transaction from the European Investment Fund. In addition to this new agreement, there are still 20 million euros available in Innovfin 2014, within the scope of Horizon 2020. Its aim is to support the financing of Spanish companies with fewer than 500 workers that conduct research and innovation activities and projects.

Hal-Cash. The system, which enable customers to send money to any person's mobile phone so they can withdraw it from an automatic teller machine without using a credit card, was used in 2017 by 16,469 customers, who placed 207,601 orders for the amount of 46.7 million euros. Hal-Cash provides access to financial services to groups that do not have bank accounts.

Responsible supplier management

As part of the supplier certification process, a procedure has been established to categorise the main suppliers according to environmental and social criteria, which have been added to the traditional ones of the price and quality of the product, the supplier's solvency, labour risks, and security.

In addition, an environmental clause has been added, a social clause in the framework agreement that all suppliers sign.

It should also be pointed out that Bankinter's average payment period to its suppliers is 20 days.

Corporate culture/brand management

The efficient brand strategy helps the Company to achieve a better positioning in the market, which also means an improved reputation and higher valuation by stakeholders.

In 2017, the Bankinter Brand development project was launched. Accessibility criteria were considered in the digital environment and the font and colour contrasts were adapted.